3Q25 Letter: Markets Rally, AI in Focus

To get our market insights delivered directly to your inbox, sign up here.

Business Update

During 2025, Evolve Investing continued to expand the number of households we serve. Our assets under management are up 44% year-to-date. Looking ahead, Chris and I plan to strengthen our team by early 2026 and introduce enhanced services. More to come soon.

Market Strength and Shifting Sentiment

The third quarter surprised many investors, with a risk-on rally that extended the momentum from May and June. The S&P 500 gained roughly 7.9% during the quarter, pushing year-to-date returns comfortably into double digits. Growth and AI-linked names continued to lead, while record highs across major indices reflected improving investor sentiment.

It was also encouraging to see small-cap and value stocks regain traction, with the Russell 2000 outperforming the S&P 500. This rotation suggests renewed confidence in smaller and more economically sensitive companies, many of which have seen upward earnings revisions in recent weeks.

Russell 2000 vs. S&P 500. 3Q25 Performance

A More Dovish Fed

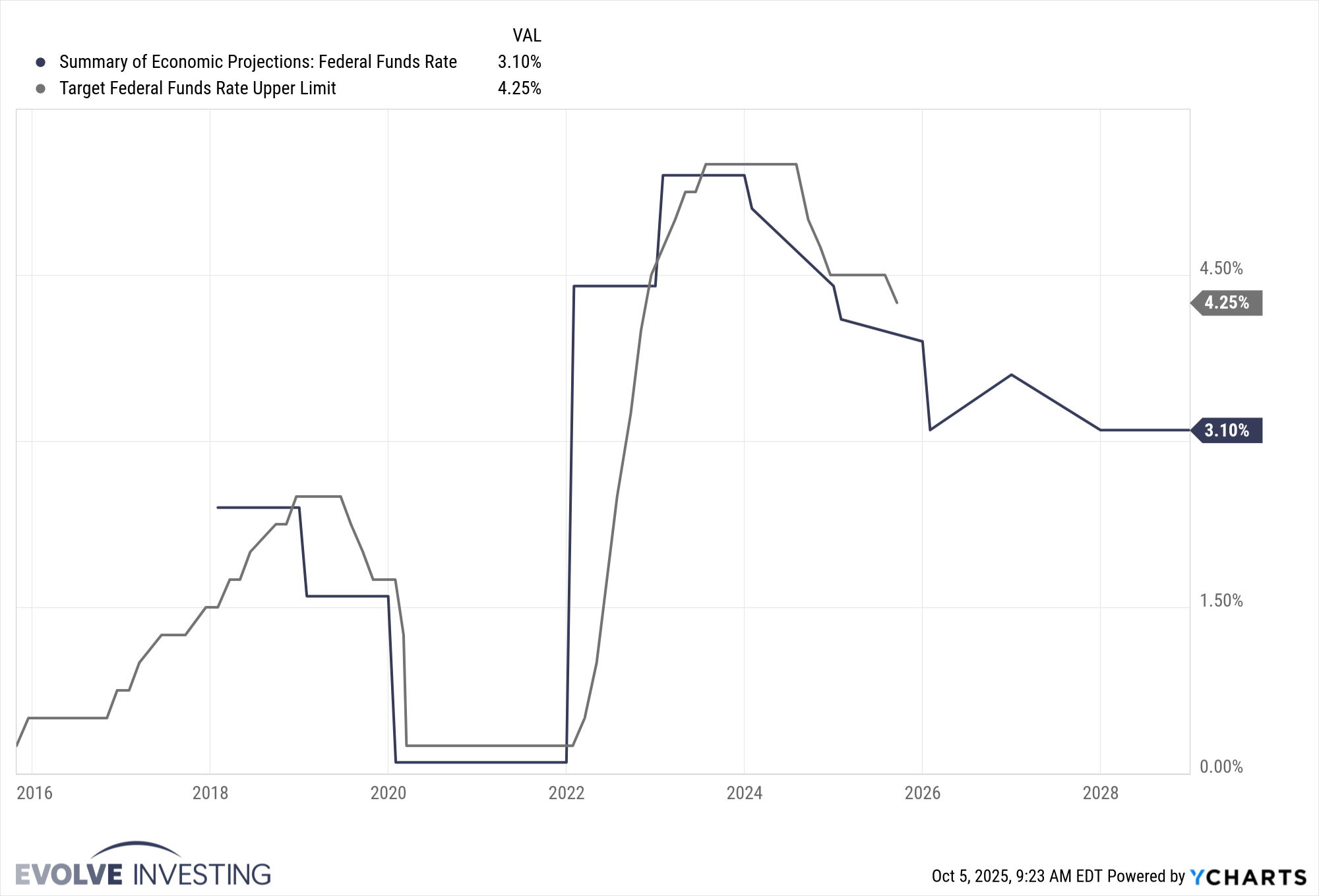

On the monetary policy front, the Federal Reserve cut interest rates by 25 basis points, setting a new target range of 4.00% to 4.25%. The statement accompanying the decision acknowledged ongoing uncertainty and rising downside risks to employment. Regional Fed leaders expressed mixed views on how much further to ease, balancing inflation management with the need to support a softening labor market.

The result is a new phase of monetary policy, one focused less on when easing will start and more on how it will evolve. This shift has been broadly supportive of risk assets, suggesting that the rally we’ve seen reflects a recalibration rather than a full reset.

Federal Funds Rate: Current and Projected

Deep Dive: Is AI in a Bubble?

Many clients have asked whether the strong performance of AI-related companies signals an overvalued market. It’s a fair question. The so-called “Magnificent Seven” mega-cap tech firms have contributed nearly half of the S&P 500’s gains since April.

There is, however, some fundamental support behind these results. According to Bloomberg Intelligence, earnings for the Mag Seven are projected to rise more than 15% in 2026, supported by revenue growth of about 13%. By comparison, the rest of the S&P 500 is expected to grow earnings by roughly 13% and revenue by 5.5%.

Reported & Projected Earnings, Mag Seven vs. Rest of Market

Comparisons to the dot-com era are understandable, but today’s environment differs in key ways. While there is still abundant capital and valuations are at the higher end of historical ranges, many of the leading AI companies are supported by strong balance sheets and diverse revenue streams rather than pure speculation.

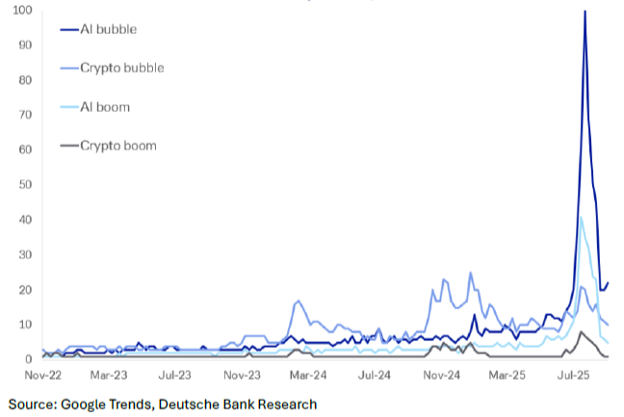

Still, it’s important to remain mindful of investor psychology. Deutsche Bank’s Adrian Cox, who tracks search and media trends around the term “AI bubble,” found that public interest peaked in August and then faded (research via this link). Historically, that kind of complacency can appear late in a cycle, when valuations are stretched and optimism is widespread.

Web Searches for AI Bubble, Crypto Bubble, AI Boom, Crypto Boom

While AI-related spending shows no signs of slowing, many analysts believe that any potential bubble could take time to unwind. Capital expenditure forecasts for next year continue to rise, and the real financial strain may not surface until 2027 and beyond, when depreciation from newly built data centers begins to pressure corporate earnings. Predicting when sentiment will shift is notoriously difficult, and history suggests it often happens only after complacency has set in. As Deutsche Bank highlighted in its report:

Vigilance is both prudent and a reminder of how hard it is to time the market.

Leading AI sceptic Gary Marcus predicted in 2022 that AI was “hitting a wall”. One prominent US financial media outlet, which published a report at the end of last week asking when the surge in AI spending will pay off, already ran a story called “Is the AI Boom Heading for a Bust?” in March and “Can AI Startups Outrun Dot-Com Bubble Comparisons?” last June.

AI has the potential to be transformative, but as investors, it’s important to stay anchored in fundamentals rather than speculative expectations. That’s why I continue to emphasize companies with strong free cash flow and disciplined capital allocation, businesses capable of sustaining profitability even if AI-driven revenues take longer to materialize.

As Always, Asset Allocation Matters

During this rally, almost all Evolve Investing clients remained in broadly diversified portfolios. While individual risk appetites and allocations vary, the core remains intact: balanced exposure across stocks, bonds, cash alternatives, and select hedges. We don’t chase themes; we align positions to time horizons, liquidity needs, and the capacity to stay invested through volatility.

For many of our clients, a more diversified allocation strategy has served them well in 2025. The Bloomberg U.S. Aggregate Bond Index, a benchmark for investment-grade issues, is up roughly 6.4% year-to-date. The Bloomberg US High Yield Very Liquid Index is up 7.4%. Taken together, the performance of bonds and credit underscores why disciplined allocation, rather than market timing, is central to managing risk and sustaining portfolios over multiple cycles.

We continue to lean on credit segments with favorable yields, emphasize liquidity buffers, and maintain modest tactical flexibility. Our guiding philosophy has not changed: portfolios grounded in fundamentals, built around realistic return assumptions, and disciplined through turbulence.

Looking Ahead: Risks & Opportunities

We remain constructive, but cautious. Key drivers we’re watching:

Fed path and inflation dynamics. The Fed’s move lower was significant, but further cuts will be data-dependent. Inflation metrics and labor trends remain mixed.

Tariff and trade policy evolution. The earlier trade shocks still cast a long shadow. How global supply chains respond deserves close attention.

Earnings surprises. Q3 earnings estimates remain modestly positive (e.g. +5% year-over-year), but execution will be key.

Valuation risks. Elevated multiples across equity markets leave little margin for error.

Theme fatigue and rotation. The AI narrative may remain dominant, but capital ubiquity suggests rotation opportunities, particularly into smaller-cap companies, may reemerge.

Please feel free to reach out if you’d like to review your allocations or walk through how we’re positioning through this environment. As always, we’re grateful for your trust and partnership.

Best,

Peter Hughes, CFA, CPWA®, CEPA® & Chris Stevenson, CFA